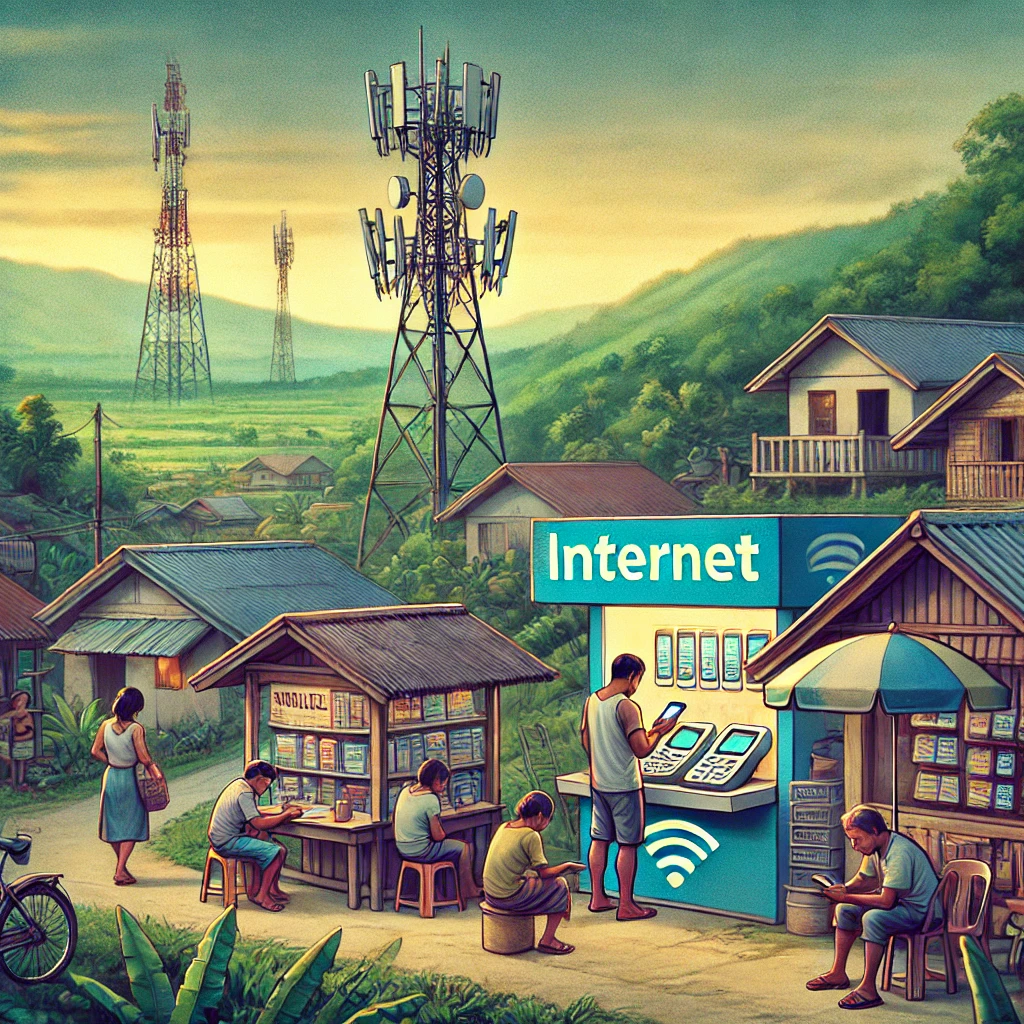

Access to reliable internet is increasingly crucial, especially for those in rural areas. In the Philippines, where many communities are located far from urban centers, internet access remains a challenge. However, the growing availability of online payment options has enabled rural residents to manage their internet services more efficiently. This article explores the various online payment methods that have made internet access more accessible in these regions.

One of the most common payment options is mobile wallet services, which allow users to pay for internet services using their smartphones. These platforms are highly convenient, especially in areas where banking institutions are scarce. Users can load funds onto their mobile wallets at local stores, and with a few taps, they can pay for their internet services without needing to travel to a distant payment center.

Bank transfers are another popular option, especially for those with access to online banking. Many rural Filipinos rely on this method to pay for their internet services, as it allows them to transfer funds directly from their bank accounts. This method is particularly useful for households with stable bank access and those who receive regular remittances from family members working abroad.

For those without bank accounts or mobile wallets, over-the-counter payment centers are a viable alternative. While this option requires a visit to a local payment hub, it remains popular in rural areas where internet service providers (ISPs) partner with convenience stores and payment centers to facilitate payments. Residents can settle their bills by paying in cash, which is still a dominant form of transaction in many parts of the country.

Prepaid internet plans also offer flexibility for rural users. These plans allow users to purchase data bundles from local stores or online platforms. Once purchased, users simply enter a code to activate the service. This method has grown in popularity due to its affordability and the fact that it doesn't require a regular billing cycle, making it ideal for users with limited budgets.

In addition to these options, digital platforms are expanding to include rural areas in their service networks. These platforms allow customers to link their internet payments to various digital banking services or e-commerce systems, further simplifying the process. This integration makes it easier for rural residents to pay for internet services while promoting digital literacy in these communities.

In conclusion, the availability of diverse online payment options has been a key factor in expanding internet access to rural areas in the Philippines. Whether through mobile wallets, bank transfers, over-the-counter payments, or prepaid plans, these options provide rural residents with the flexibility they need to stay connected in an increasingly digital world.